This year’s carbon plan update has high stakes for NC offshore wind. Here’s why.

General

Posted by: TotalEnergies Carolina Long Bay

1 year ago

This year’s carbon plan update has high stakes for NC offshore wind. Here’s why.

By: Adam Wagner

Article from The News & Observer

The cost of potential wind farms off North Carolina’s coast — and what Duke Energy customers end up paying for them — will be heavily influenced by an N.C. Utilities Commission decision later this year, a TotalEnergies official says.

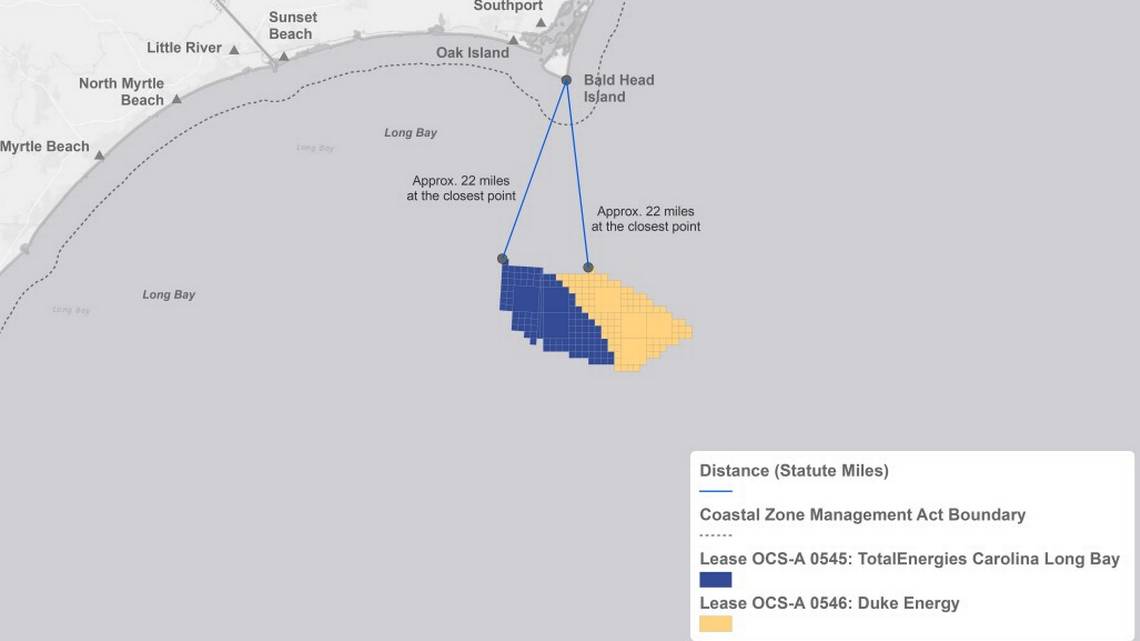

TotalEnergies holds one of three wind energy leases off of North Carolina. Its development area is about 22 miles off Bald Head Island, sharing a border with one leased by Cinergy, a company owned by Duke Energy.

Starting construction in those wind energy areas before 2032 is vital to securing tax credits that could equal half of the total value of their construction, said Jen Banks, TotalEnergies’ permitting and development coordinator for the company’s North Carolina lease.

Whether that happens could be heavily influenced by the Utilities Commission’s order later this year in Duke Energy’s joint carbon reduction and resource plan case, Banks said while speaking on a UNC Cleantech Summit panel on Friday.

Duke-owned Cinergy and TotalEnergies have worked together on initial surveys off the Brunswick County coast, trying to identify sights that are appropriate to anchor buoys to the seafloor that will collect information about weather and wind speeds.

The U.S. Bureau of Ocean Energy Management, which leases wind energy areas and oversees their development, is in the process of reviewing those site assessments, Banks said, with the companies expecting approvals later this year.

If those are granted, Banks said, the pace of development is heavily reliant on the Utilities Commission.

“We kind of have two paths. We could see a strong commitment from the Utilities Commission for offshore wind, and in that case we will keep moving. We could also see that there’s no solid commitment to offshore wind. In that case we’re going to have a delay, a pause in our development activities,” Banks said.

Such a pause would imperil developers’ ability to obtain key tax credits that could significantly reduce the impact building wind farms will have on utility bills.

Key Tax Credits

Tax credits intended to encourage the construction of offshore wind farms were among the many clean energy efforts included in 2022’s Inflation Reduction Act.

Those credits are worth 30% of a company’s total investment in an offshore wind project if developers meet wage and apprenticeship requirements, 10% if the project meets domestic manufacturing thresholds and 10% if an offshore wind farm comes onshore in a place the federal government defines as an “energy community” due to its links to fossil fuel industries.

Those savings could be significant, particularly considering the steep costs of building an offshore wind farm.

For instance, Dominion projects that the 2.6 gigawatt wind farm it plans to start building about 27 miles off Virginia Beach will cost $9.8 billion. If Dominion is able to hit all of the targets, it could receive a tax credit of $4.9 billion.

The bill starts to phase out those credits in the later of 2032 or when the power sector’s greenhouse gas emissions dip 75% below 2022 levels. To guarantee the incentives, Banks said, North Carolina should ramp up its offshore wind efforts by 2032.

“From our perspective it’s really an issue of not leaving dollars on the table and bringing value straight back to ratepayers,” Banks said.

Duke Energy’s Plans

Offshore wind could be part of Duke Energy’s power generation mix sooner than the utility had been expecting, company officials indicated in a resource plan update filed earlier this year.

To meet increased demand while continuing to cut carbon dioxide emissions, Duke’s models showed 800 megawatts of offshore wind coming online by 2033 and an additional 1,600 megawatts online by 2035.

That was a change from the company’s original filing, in August 2023. In that version, Duke’s recommended pathway did not select offshore wind but left open the possibility of adding some turbines in the 2030s depending on market conditions like solar prices, natural gas supplies and the availability of small modular nuclear reactors.

Wind energy could play a key role in the state’s energy mix, according to a Duke official on Friday’s panel.

Turbines are always generating some power, but most importantly they tend to generate the most power on winter mornings, during winter storms and on summer afternoons. Those are the times when the demand on Duke’s grid is the highest and, in some cases, times when solar panels that aren’t paired with a battery aren’t generating power.

“We know that North Carolina, being a winter peaking state, we can’t count on solar in and of itself when we are experiencing that peak demand before the sun comes up in January. The beauty, particularly of an offshore wind resource, is it complements our system well,” said Mark McIntire, the director of Duke Energy’s government affairs team for energy, the environment and stakeholder engagement in North Carolina.

McIntire added that he also expects onshore wind to play a significant role in Duke’s future energy mix. Both the August plan and the update call for 1,200 megawatts of onshore wind by 2033, growing to 2,300 megawatts by 2038.

Duke’s January 2024 update asked the Utilities Commission to allow the utility to undergo a request for information to explore the cost of procuring 2,400 megawatts of offshore wind.

Banks and TotalEnergies said that if the Utilities Commission could provide additional certainty that Duke would buy offshore wind power, the projects could move more quickly.

She pointed to projects off of New York and New Jersey that were leased in February 2022 and have moved through permitting significantly more quickly than the North Carolina projects because developers knew there would be buyers for the power they will generate.

“We can’t make those investments past what we’ve done now until we have that certainty,” Banks said.

Read more at: https://www.newsobserver.com/news/politics-government/article286996470.html

Categories:

You May Be Interested In:

Wind Energy Is Vital for North Carolina

8 months ago by TotalEnergies Carolina Long Bay

As North Carolina gears up for offshore wind energy, Virginia provides some pointers

11 months ago by TotalEnergies Carolina Long Bay

Recent polling of NC voters shows support is increasing for offshore wind

12 months ago by TotalEnergies Carolina Long Bay

Clean Energy Podcast Spotlights Offshore Wind’s Significant Potential for the Carolinas

1 year ago by TotalEnergies Carolina Long Bay